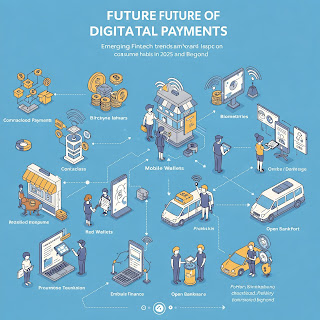

The Future of Digital Payments: Emerging Fintech Trends and Their Impact on Consumer Habits in 2025 and Beyond

The Future of Digital Payments: Emerging Fintech Trends and Their Impact on Consumer Habits in 2025 and Beyond

An in-depth analysis of the evolving landscape of digital payments, exploring the latest fintech innovations and their profound influence on how consumers transact.

The Ascendancy of Digital Wallets: Convenience and Integration

Digital wallets have moved beyond a mere novelty to become a cornerstone of modern digital payments. In 2025 and beyond, their adoption is expected to surge further, driven by their convenience, security features, and increasing integration with various services. Platforms like Apple Pay, Google Pay, and Samsung Wallet offer seamless payment experiences across online and offline environments. The ability to store multiple payment methods, loyalty cards, and even digital IDs within a single application streamlines transactions and reduces the need for physical cards.

Furthermore, the integration of digital wallets with other applications, such as ride-sharing services, e-commerce platforms, and even public transportation systems, enhances their utility and encourages wider adoption. We are witnessing a convergence where digital wallets become central hubs for various financial and non-financial interactions. This interconnectedness provides a frictionless experience for consumers, making digital wallets an increasingly indispensable tool in their daily lives. The focus on user experience and the continuous addition of new features will be key drivers in the continued growth of digital wallet usage.

Cryptocurrencies and Blockchain: Reshaping Transactions and Trust

While still navigating regulatory landscapes and volatility, cryptocurrencies and the underlying blockchain technology are poised to play a more significant role in the future of digital payments. In 2025, we can expect to see greater adoption of cryptocurrencies for specific use cases, particularly in cross-border transactions and niche markets. The speed and lower fees associated with certain cryptocurrencies compared to traditional banking systems make them an attractive alternative for international money transfers.

Blockchain technology, beyond its application in cryptocurrencies, offers the potential for more secure and transparent payment systems. Its decentralized and immutable nature can reduce fraud and enhance trust in digital transactions. We may see the emergence of blockchain-based payment platforms that offer greater security and efficiency for both consumers and businesses. The development of stablecoins, cryptocurrencies pegged to the value of traditional currencies, aims to mitigate volatility and make them more suitable for everyday transactions.

However, widespread adoption of cryptocurrencies for mainstream payments still faces challenges related to regulation, scalability, and user-friendliness. Education and the development of more intuitive interfaces will be crucial in bridging the gap between the complex world of crypto and the average consumer. The interplay between central bank digital currencies (CBDCs) and private cryptocurrencies will also be a key factor shaping the future landscape.

The Evolution of Contactless Payments: Beyond Tap-to-Pay

Contactless payments have gained significant traction in recent years, and their evolution is set to continue. While tap-to-pay using NFC (Near-Field Communication) technology remains prevalent, we can expect to see the emergence of more innovative contactless payment methods. Technologies like QR code-based payments are gaining popularity in various regions due to their ease of implementation and accessibility on a wider range of devices.

Furthermore, advancements in biometric authentication, such as fingerprint and facial recognition, are being integrated into payment processes to enhance security and convenience. Imagine authorizing a payment simply by looking at your phone or scanning your fingerprint. These technologies offer a frictionless and secure alternative to traditional PINs and passwords. The integration of these biometric methods with digital wallets and other payment platforms will further streamline the payment experience.

The Internet of Things (IoT) also presents exciting possibilities for the future of contactless payments. Connected devices, from smartwatches and fitness trackers to smart home appliances and even vehicles, could become payment terminals. Imagine paying for groceries directly through your refrigerator or paying for fuel through your car's dashboard. While still in its nascent stages, this integration of payment capabilities into everyday objects holds immense potential for transforming how we transact.

The Impact on Consumer Habits: Convenience, Security, and Personalization

The proliferation of these digital payment technologies is profoundly impacting consumer habits. Convenience remains a primary driver, with consumers increasingly opting for payment methods that are fast, easy to use, and readily accessible on their mobile devices. The ability to make payments with a few taps or scans has become an expectation for many, particularly among younger generations.

Security is another crucial factor influencing consumer adoption of digital payments. As digital transactions become more prevalent, consumers are increasingly concerned about the security of their financial data. Fintech companies and payment providers are continuously investing in advanced security measures, such as tokenization and encryption, to protect user information and build trust. The transparency and security offered by technologies like blockchain could further enhance consumer confidence in digital payments.

Personalization is also emerging as a key trend in the future of digital payments. Fintech companies are leveraging data analytics and artificial intelligence to offer personalized payment experiences, such as tailored rewards programs, spending insights, and proactive fraud detection. This level of personalization can enhance user engagement and loyalty, making digital payments more integrated into consumers' financial lives.

Navigating the Regulatory Landscape and Ensuring Security

The rapid evolution of digital payments necessitates a dynamic and adaptive regulatory landscape. Governments and financial authorities worldwide are grappling with how to regulate new technologies like cryptocurrencies and ensure fair competition and consumer protection. Striking the right balance between fostering innovation and mitigating risks will be crucial for the sustainable growth of the digital payments ecosystem. Clear and consistent regulations will be essential for building trust and encouraging widespread adoption.

Security remains paramount in the digital payments space. As payment methods become more sophisticated, so do the threats. Continuous innovation in cybersecurity and fraud prevention technologies is essential to safeguard consumer data and maintain the integrity of the payment system. Collaboration between fintech companies, financial institutions, and regulatory bodies will be crucial in addressing emerging security challenges and fostering a secure digital payment environment.

Looking Ahead: The Continued Transformation of How We Pay

The future of digital payments in 2025 and beyond promises to be dynamic and transformative. The convergence of mobile technology, blockchain, AI, and IoT will continue to drive innovation and reshape how consumers transact. We can expect to see even more seamless, secure, and personalized payment experiences emerge, further integrating digital payments into the fabric of our daily lives. The key players in the fintech space will be those who can prioritize user experience, security, and adapt to the evolving regulatory landscape.

The impact on consumer habits will be profound, with a continued shift towards digital-first payment preferences. Understanding these evolving trends and adapting to them will be crucial for businesses and consumers alike in navigating the exciting future of digital payments. The journey from physical currency to a fully digital payment ecosystem is well underway, and the innovations we see in 2025 will be significant milestones in this ongoing transformation.